Mumbai: Axis Bank in collaboration with Freecharge, has introduced India’s first Gold-Backed Credit on UPI, a pioneering product designed to provide instant and flexible access to secured credit.

The Gold-Backed Credit on UPI enables customers to unlock credit against their gold assets with a fully digital process.

Tailored for micro, small and medium enterprises (MSMEs), self-employed professionals, and merchants, the solution offers seamless onboarding and repayments through the Freecharge app or any UPI platform.

The credit line is available to Axis Bank customers across all branches processing gold loans. It eliminates the need for physical visits post-onboarding and ensures transparent, real-time cash flow management. Interest is charged only on the utilized amount, making it a cost-effective solution for working capital, liquidity requirements, and business growth.

Gold-Backed Credit on UPI for MSMEs and Entrepreneurs

Repayments can be made instantly via UPI or UPI QR codes, allowing customers to manage their credit in real time. The partnership with Freecharge ensures a smooth digital experience, covering onboarding, registration, transactions, and repayments without manual intervention.

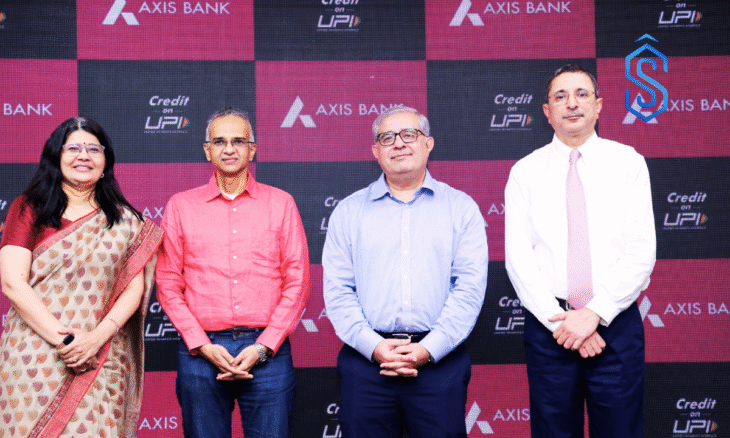

Munish Sharda, Executive Director, Axis Bank, said: “With Gold-Backed Credit on UPI, Axis Bank is redefining secured credit for the digital era. By combining the trust of gold with the convenience of UPI, we are delivering flexible, instant credit solutions to customers across India.”

Sohini Rajola, Executive Director – Growth, NPCI, added: “Credit on UPI provides a robust framework to extend secured credit access. Axis Bank’s gold-backed product is a strong example of how UPI can simplify and expand financial inclusion.”

Also Read: TransUnion CIBIL Credit Market Report: Steady Rural Credit Demand in June 2025 Quarter

Strengthening India’s Digital Lending Ecosystem

The launch aligns with NPCI’s recent framework for Credit Lines on UPI, underscoring Axis Bank’s focus on innovation and financial inclusion.

It marks a significant advancement in secured digital credit, combining Axis Bank’s lending expertise with Freecharge’s digital platform capabilities to create a first-of-its-kind product in India.